Pangkow-China Agricultural Machinery Parts Market Sentiment Index (SPI) Business Report for October

Release Date:2021-12-09

The SPI index was 47.85% in October.

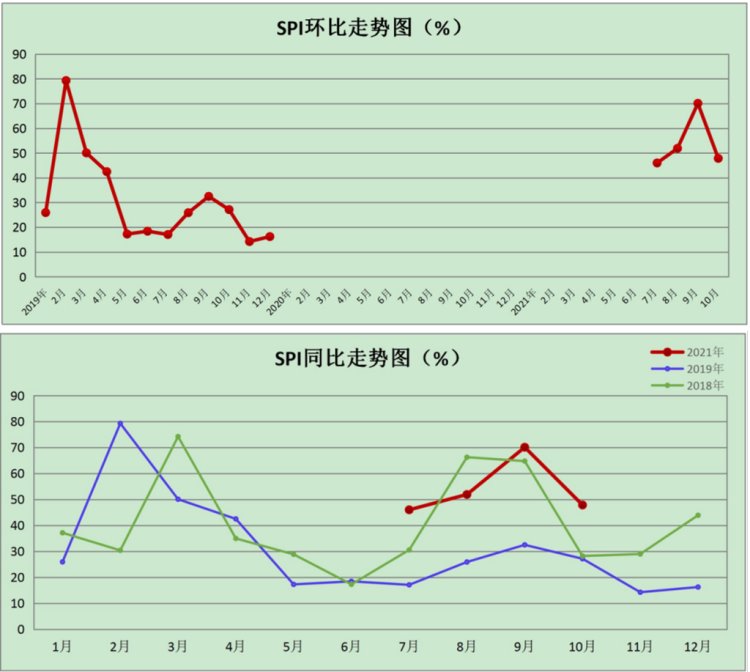

The October 2021 Pangkou-China Agricultural Machinery Parts Market Prosperity Index (SPI) jointly released by Gao Yang County Agricultural Machinery and Auto Parts Production and Circulation Association, China Pangkou Agricultural Machinery Parts Market Management Committee, Gao Yang County Hao Sheng Sanong Industrial Co., Ltd. and Pangkou-China Agricultural Machinery Expo City is 47.85%, down 22.24 percentage points YoY and up 20.72 percentage points.

In October, the SPI suffered a "cold spell", the prosperity of a substantial "cooling", showing two prominent features. The first is a precipitous decline in the prosperity of the ring, down through the Ronggu line, into the recession range; the second is the month-on-month (compared with the same period in 2019) to 20.72% increase in a significant climb. A significant decline in the ring means that the SPI three consecutive months of upward period ended, the market "into the winter", to open the decline mode; a significant climb year-on-year, indicating that the market this year is still better than in previous years.

The main reasons for the substantial decline in the market chain are the following: First, the seasonal impact. Analysis from the SPI trend law, October is the inflection point of the SPI in previous years, the market decline in line with the SPI trend of the basic law of development. Ring "high dive" mainly because the boom in September up to 70% or more, built into the boom "high" due to; Second, the demand side of multiple negative factors, the reduction in demand. First, the floods led to a reduction in the number of maintenance equipment. This year, some regions suffer from floods, slippery fields, resulting in wheeled equipment can not work in the field, the number of operating equipment to reduce the number of repair equipment and the formation of a linkage with the number of agricultural machinery parts market demand has a greater impact; second is the power limit caused by the host production enterprises demand decline. Due to power restrictions in some areas, many enterprises are underemployed, parts demand decline; Third, the host market is cold, reduce production. From the host market, due to floods, epidemics, power restrictions, the decline in the income of the mechanics, agricultural subsidies "overdraft" serious and other multiple negative factors, the potential market demand is suppressed to a certain extent, the golden nine silver ten color is not enough, early into the off-season. Many manufacturers to reduce production, demand for parts and components; fourth, the price of raw materials, many small enterprises or stop production or reduce production, demand for parts and components fell; fifth, parts and components export growth slowed down, the contribution rate decreased, the SPI also had a certain impact.

We judge that the SPI will remain in the recession range in November, the boom will continue to decline. The chain will continue to fall, but given the formation of the prosperity of 2019 "puddle", year-on-year will still show solid growth. 6 primary indexes, will all fall into the recessionary range, the chain continues to decline. Based on the "puddle" of prosperity in 2019, there will be varying degrees of year-over-year growth.

November SPI market is located in the recession range mainly because: First, November is the parts market off-season, in the agricultural season, agricultural machinery maintenance and host plant production are at a monthly low, parts demand is low; Second, from the host market, the Chinese Agricultural Machinery Circulation Association released in October AMI forecast, November host market will be even more dismal, the enterprise down production plan is probable thing Second, from the host market, the Chinese Agricultural Machinery Distribution Association released the October AMI forecast, the host market in November will be more dismal, enterprises cut production plans is a probable thing, the market demand for accessories has a strong negative impact. Third, from the distribution side, the vast majority of dealers in November will be compressed inventory, return capital, reduce parts inventory, parts demand subsequently reduced; fourth, from the SPI popularity and market confidence in the analysis of two key indicators, first look at the popularity index in October, although the prosperity is high - hovering near the Rongkuk line, but the ring but there is a precipitous slide; then look at the market confidence index, ringgit decline of more than 20%, the boom hit the lowest this year, just 28.5%, the two released the same strong negative signal. Fifth, from the analysis of the SPI year-on-year trend curve in 2018 and 2019 for the past two years, November is located at a low level, and this year, if there are no occasional and critical surprises, its running rule will not be broken.

Analysis of the development trend from the supply side of the SPI, China's parts production, although overall still dominated by low and medium value-added products, but in recent years, some companies began to gradually achieve breakthroughs in the core products. The rise of independent brands and overseas mergers and acquisitions to undertake industrial transfer for the development of China's parts and components enterprises to provide opportunities. China's agricultural machinery market share of independent brands continue to climb, independent brands to establish their own parts system demand will be accompanied by the rise of a number of independent core parts enterprises. This requires dealers to firmly grasp the development trend of China's agricultural machinery auto parts industry, out of the parts business operation from low value-added to high value-added transformation of the new way. At the same time focus on the export market, open up new growth channels.

A, a level of index operation

(i) Sales index

In October, the sales index was 50.02%, down 28.89 percentage points from the previous month and up 22.88 percentage points from the previous year, which was in the boom range.

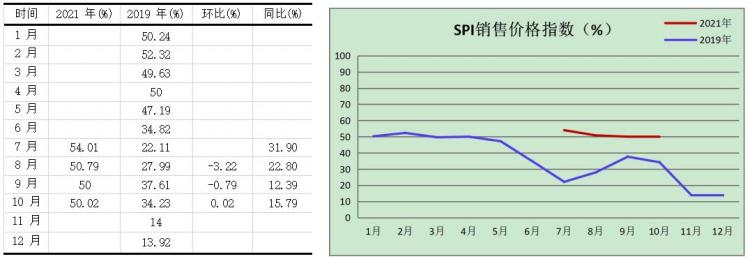

(ii) sales price index

In October, the sales price index was 50.02%, up 0.02 percentage points from a year earlier, up 15.79 percentage points from a year earlier, located in the boom range. Sales price index stabilized and has been maintained in the boom range, meaning that the market gradually from the past price competition gradually towards quality competition.

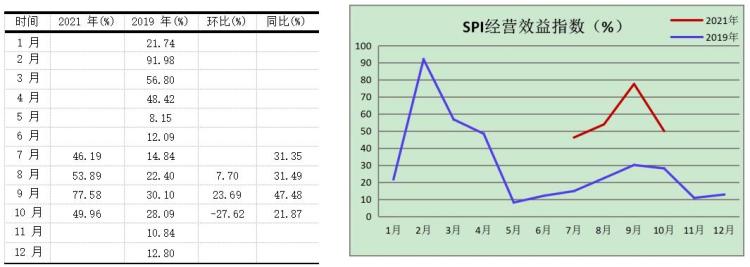

(iii) Operating efficiency index

In October, the operating efficiency index was 49.96%, down 27.62 percentage points from a year earlier and up 21.87 percentage points from a year earlier, located in the recessionary range. Although the operating efficiency index dropped significantly, it still maintained a high level of prosperity, and its decline was mainly due to the decrease in sales.

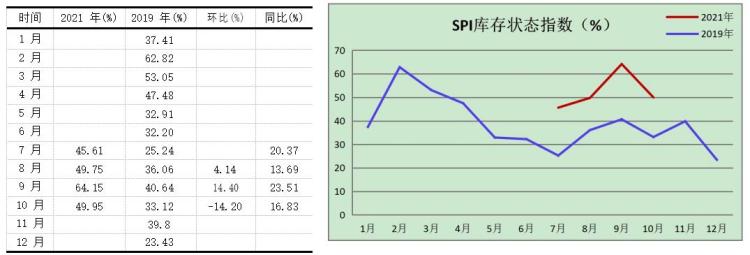

(iv) Inventory Index

In October, the inventory index was 49.95%, down 14.20 percentage points from a year earlier and up 16.83 percentage points from a year earlier, and was in the depressed range.

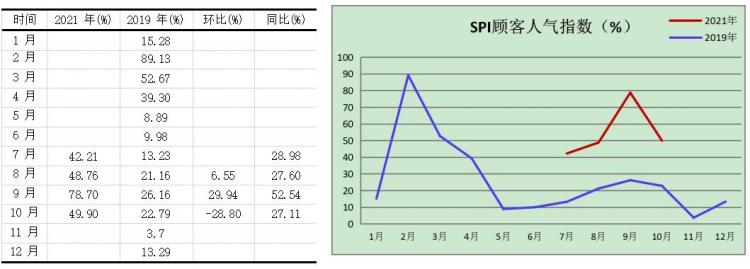

(v) Popularity Index

The popularity index was 49.90% in October, down 28.80 percentage points from a year earlier and up 27.11 percentage points from a year earlier, in the depressed range.

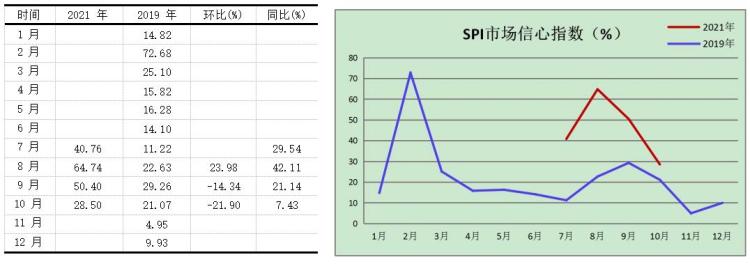

(vi) Market Confidence Index

In October, the market confidence index was 28.50%, down 21.90 percentage points from a year earlier and up 7.43 percentage points from a year earlier, in the depressed

The range. The market confidence index has dropped significantly, and the prosperity is at the lowest point since July, which means that dealers are not confident about the next market, reflecting that SPI may be more dismal in November.

Second, the operation of secondary indices

(i) Parts IndexTractor

In October, tractor parts index of 49.77%, down 28.02 percentage points, up 24.39 percentage points, located in the depressed range.

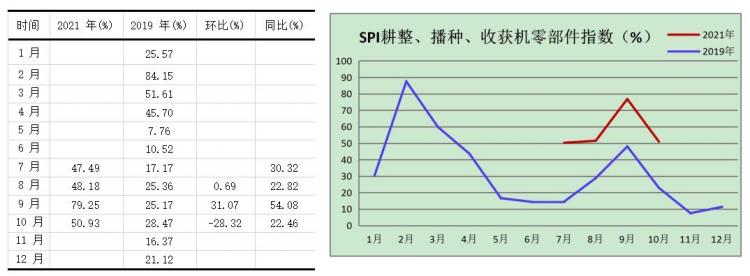

(ii) tillage, planting, harvesting machinery parts index

In October, tillage, sowing, harvesting machinery parts index of 50%, down 26.81 percentage points, up 27.09 percentage points, located in the boom range. The index is located in the boom range, to a large extent from the seeder market season delayed due to flooding this year, the sowing period was delayed, the seeder market season was postponed, the host production and maintenance of dual power to stabilize the parts market boom.

(iii) Electrical, instrumentation, cab, covering parts index

In October, the electrical, instrumentation, cab, covering parts index was 50.93%, down 28.32 percentage points from a year earlier, up 22.46 percentage points from a year earlier, in the boom range.

(iv) Plant protection, sprinkler parts index

In October, the index of plant protection and sprinkler parts was 41.03%, down 38.97 percentage points from a year earlier and up 7.80 percentage points from a year earlier, located in the recessionary range. The host market into the off-season and the end of agricultural affairs is the main reason for the substantial decline in the index chain.

(v) hardware processing, consumables, bolts index

In October, the index of hardware processing, consumables, bolted connectors was 49.69%, down 29.67 percentage points from a year earlier, up 23.28 percentage points from a year earlier, and located in the recessionary range.

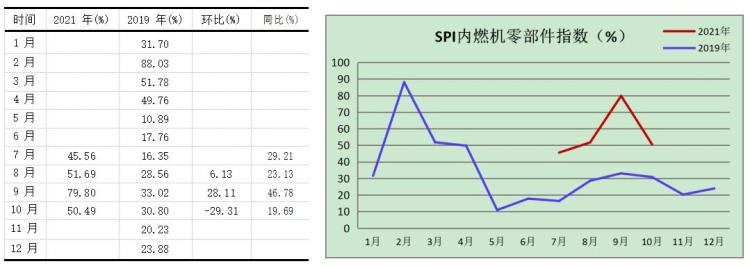

(vi) internal combustion engine parts index

In October, the internal combustion engine parts index was 50.49%, down 29.31 percentage points from a year earlier, up 19.69 percentage points from a year earlier, located in the recessionary range.

(vii) Transportation engineering parts index

In October, the transport engineering parts index was 50, down 30 percentage points from the previous month, up 22.50 percentage points from the previous year, located in the boom range. During the agricultural season, rural trade entered the peak season, thus ensuring that the index is stable in the boom range.